Australia’s Commonwealth Bank invests in UK compliance technology company Global Screening Services

Commonwealth Bank of Australia (CBA) has expanded its support for innovative sanctions compliance technology by investing in Global Screening Services (GSS), a UK-based RegTech company that specialises in payments screening.

CBA has taken a minority shareholding in GSS as part of the company’s US$47 million (£37.3 million) Series A2 capital raising. CBA is GSS’s first significant, and to date only, Australian investor. Details of CommBank’s investment have not been disclosed.

Founded in 2021, GSS provides sanctions compliance and transaction screening solutions for financial institutions which are designed to reduce process duplication and error rates in the screening process.

Nigel Williams, CBA’s Group Chief Risk Officer, said, “The investment in GSS is part of the bank’s ongoing commitment to innovation to deliver better customer experiences. Following this investment, we are assessing the system for application in international payment flows.”

The Commonwealth Bank of Australia is a member of GSS’s advisory board which consists of more than 30 leading global banks who have collaborated over the past 18 months to collectively agree on a technology ‘blueprint’ and consistent standards for financial institutions to adopt and improve compliance and processing standards.

GSS’s aim is to improve effectiveness and efficiency in international payments and create less friction in payment flows to benefit bank customers.

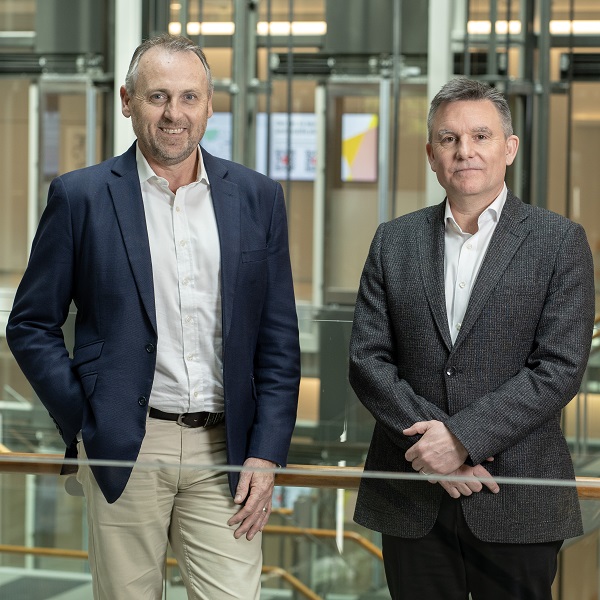

As part of its investment in GSS, CBA is able to appoint an observer to the company’s main board. The bank will be represented by its Executive General Manager Financial Crime Compliance, John Fogarty (pictured left).

Fogarty said, “Banks play a critical role in combating financial crime and protecting their customers, the community and integrity of the financial system. We’re excited about the potential of GSS with its global reach and look forward to seeing how CBA can potentially utilise this technology to continue to prevent sanctioned parties from accessing and moving money into or out of Australia, whilst also speeding up the millions of international payments for our customers.”

In welcoming CBA as a shareholder, Tom Scampion (pictured right), GSS’s CEO, said, “Sanctions screening is both an international security imperative and one of the major sources of friction in the global payment system – at a time when customers and businesses are increasingly demanding real-time payments. We are excited to be working with a bank of the stature of CBA.”