Moneyhub partners with financial analytics pioneer Envizage for financial planning first

Open Data and payments platform Moneyhub have partnered with financial analytics pioneer Envizage to deliver the world’s first customer-directed Open Banking-powered financial planning application.

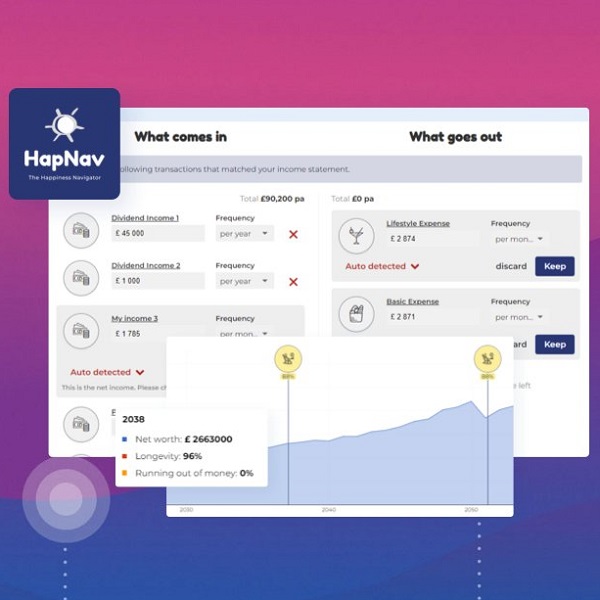

The Happiness Navigator (HapNav) is a ground-breaking digital planning experience from the Academy of Life Planning that allows end consumers to identify and manage risks to their future financial plans and aspirations. It is powered by Moneyhub’s Open Banking data and Envizage’s simulation capabilities.

The two fintechs share a commitment to helping consumers make the most of their money and their financial wellness solutions complement each other perfectly. Where Envizage’s probabilistic simulation technology can help people prepare for desired future outcomes, Moneyhub’s Data & Intelligence API can provide an accurate picture of a person’s current financial position, from income and expenses, to assets, liabilities and insurance.

HapNav is made available through the Academy of Life Planning, the world’s first network of financial planners that aren’t also financial products salespeople. It’s this unique customer-centric DNA and independence that helps set HapNav apart from the competition since, unlike many planning apps in the market, the control lies firmly with the consumer.

The Open Banking-powered solution also makes a significant contribution to bridging the ‘advice gap’ that millions of people in the UK fall into to the detriment of their financial health. By putting the right decision tools in consumers’ hands, HapNav enables people to keep on track and achieve their goals.

The data and analytics provided by Moneyhub and Envizage’s APIs allow users to understand the consequences of their financial choices, navigate potential trade offs and plan for the future. With 9% of Britons having no savings at all and 41% not having enough to live for a month without income, not to mention the economic toll of Covid-19 and the ongoing cost of living crisis, this solution could not be more essential.

The launch of HapNav comes at a moment when data-sharing is a growing priority for regulators and the UK government, creating a supportive backdrop for the new planning app.

Sam Seaton, CEO at Moneyhub said, “Moneyhub exists to advance financial wellness through the power of technology, and so partnering with Envizage was both a no-brainer and a great pleasure. Open Banking and Open Finance is enabling smart customer-centric propositions to be developed in all areas of financial services and financial planning is one sector that is ripe for this disruption.

“As the industry begins to innovate in order to comply with the upcoming Consumer Duty rules, better data-sharing powered by Open Data will ensure businesses understand their customers and can offer them the very best tools and products.”

Envizage Co-Founder & CEO Vinay Jayaram added, “Without a firm grounding in your present reality, projections about your future will be hazy at best, which is why the combination of real-time data with simulation technology is so powerful. And that is why the partnership with Moneyhub, which is the data backbone for the HapNav app, has been so valuable for us and has made the app a huge success.

Steve Conley, CEO of HapNav and Academy of Life Planning, also added, “The Open Banking-powered end-user financial planning app, delivered to the personal and corporate clients of our global network of financial planners, that aren’t also financial product salespeople, is ground-breaking. One planner can now do one-hundred lifetime cash flow forecasts all at once as part of, say, a corporate financial wellbeing programme or a subscription-style on-line model. The possibilities are endless.”