55th anniversary of the UK’s first ATM: elderly concerned about to a cashless future

To coincide with the 55th anniversary of the launch of the UK’s first ATM, new research reveals Britons’ fears about the impact of a cashless society, and surprisingly how much the public still relies on cash machines and coins and notes.

The survey, carried out by 3Gem on behalf of Transact Payments Limited (TPL), found that a striking majority – 71% – of the public is worried that their elderly family and friends will be “cut off from society” if Britain becomes a cashless country.

The research finds that this worry is caused by a belief that the elderly will not be tech savvy enough to adjust to a society where all payments are made by card or digitally.

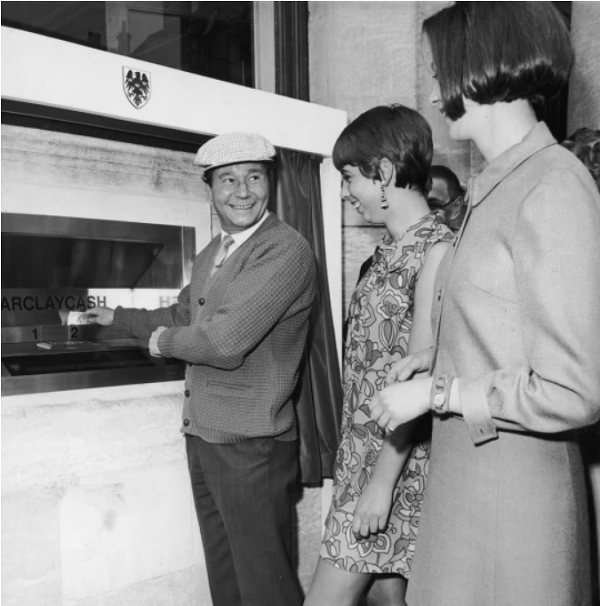

Yet the data uncovers a country still reliant on ATMs, with 62% of people saying they use a cash machine currently on a monthly basis. Just over a third (38%) admit to never using an ATM, or only needing them in the case of an emergency. The research also finds that three quarters (76%) feel that the UK will have ATMs in five years. The UK’s first automated teller machine (ATM) was installed and operational on 26th June 1967 at a Barclay’s in Enfield.

The death of cash might have been greatly exaggerated

Despite a sharp rise in the adoption of card and digital payments due to the pandemic, consumers also believe that cash is here to stay and that its death has been greatly exaggerated. One in seven (73%) of us can’t part with physical money and are carrying cash and coins.

Cash capital of the UK: Middlesbrough (at 92%) is the cash carrying capital of the UK, followed by Cambridge (91%) and Exeter (90%). Cardiff is the cashless capital of the UK and one of the only cities within this research that finds more residents (at 54% versus 46%) that carry a card instead of any cash.

Most likely to bring £20 out: Britons are most likely, at 31%, to carry £20 around in their wallet or purse, followed by £50 (25%)

A majority prefer to have a cash & card mix: The majority, (43%), like to have both cards and physical cash. Despite much focus on a potential “Britcoin” just 6% wants to see the UK have a digital currency in the future.

The research is timely as last year, the UK government launched a public consultation to examine legislation to protect access to cash. Meanwhile, in 2020, Sweden passed a bill mandating that banks need to provide an adequate level of cash services to better serve groups such as lower income workers, rural communities, the elderly and migrants, who did not have consistent access to financial services.

Bank branches closures loom large in the public’s mind

With 60 UK bank branches closing every month in 2021, availability and access to a bricks and mortar financial institution is a key concern uncovered by this research. The survey finds that two thirds (68%) of consumers would be “worried” if their area had no physical bank branches in their area in five years time.

Despite unease regarding branches potentially disappearing, most consumers rarely need to visit their local financial institution according to this research. The majority (at 44%) will only visit their bank branch in case of an emergency, while nearly a quarter (23%) “never” go. Only a third (33%) say they go to their branch in a calendar month.

TPL, which has built a reputation as the expert in payment and card solutions, conducted this research in order to gain insight and understanding into Britons’ attitudes and behaviours regarding their money, as the country currently undergoes significant social and technological changes in how people bank.

Kriya Patel, CEO of TPL, said of the findings, “Our research reveals how the UK is still highly reliant on more traditional methods of banking, which is at odds with an expectation that Britain will turn into a ‘cashless’ society very soon.”

“Critically however, it also uncovers a deep worry amongst a sizeable majority of the public about the negative impact that becoming a cashless country would have on elderly family and friends. The wholesale move away from physical coins and notes could have potentially adverse effects beyond the elderly, including lower income workers, rural communities, and more.”

“While card usage, especially contactless, has risen exponentially due to the pandemic and fundamentally changed many people’s way of paying for things, bank branches, ATMs and cash will still play a key role for society both now and in the future when it comes to banking.”