Australian investors lag behind the global trend for passive funds and are playing catch up on ESG, Calastone research shows

The shift in investor preference for passive funds over active funds continued inexorably over the last two years, but Australian investors were more resistant to the trend than their peers elsewhere in the world, according to new research from Calastone, the largest global funds network.

Calastone’s report, Tidal Forces – Can Active Funds Fight the Passive Flows?, compiled from analysis of hundreds of millions of fund transactions across its network over the last two years, shows that the global policy response to the pandemic prompted significant net fund inflows as markets began to soar from April 2020 onwards. Over the course of 2020, a net US$19.5bn (A$28.2bn) flowed across Calastone’s network into equity funds. More than half of this was in the last two months of the year.

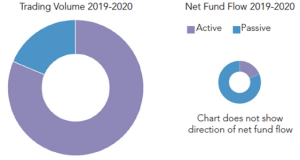

Figure 1: Net fund flows are small relative to huge trading volumes

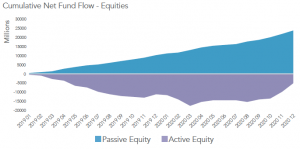

Figure 2: Net inflows for index tracking equity funds were US$23.5bn in 2019 and 2020

Australians have been even more bullish than their global peers

Australian investors were also very bullish, adding US$4.7bn/A$6.8bn to their equity fund holdings in 2020. Three fifths of this was in November and December alone as vaccine approvals raised hopes for an end to the pandemic. Relatively speaking Australian investors were more enthusiastic than their peers elsewhere. Calastone’s FFI:Equity was 54.9 in Australia compared to 52.0 for the global average (a reading of 50 means the value of buys equals the value of sells – see methodology on page 4).

Passive funds are winning the majority of new capital

Index trackers are comfortably beating active funds in the race to attract new capital. Across Calastone’s global network, they garnered inflows of US$10.0bn/A$14.4bn in 2019 and a further US$13.5bn/A$19.6bn in 2020. Across every major territory and across every equity fund category, Calastone’s indices of passive funds have outpaced their active equivalents in the last two years.

Active funds saw net outflows of US$11.4bn/A$16.4bn in 2019 and would have shed cash again in 2020 were it not for a dramatic turnaround in the final quarter. By the end of the year, investors added a net US$6.0bn/$8.7bn to their holdings (not enough to make up for 2019 outflows). Over the two-year period, Calastone’s FFI: Active Equity was 49.6 (a reading below 50 means outflows exceed inflows).

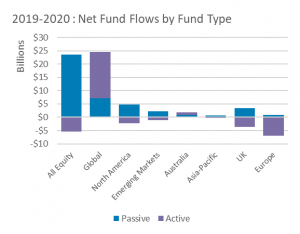

Figure 3: net flows in Australia over the two years from 1 Jan 2019 to 31 Dec 2020 were A$5.7bn for active funds and A$3.6bn for passive funds. Note, net inflows for index tracking equity funds were US$23.5bn over this period, while active funds shed $5.4bn.

But in Australia active funds were ahead in cash terms

In Australia, the preference for passive funds has been less clearly ahead of active funds than elsewhere. Australians added modestly to their active fund holdings in 2019 and significantly in 2020, in contrast to the rest of the world. Over the two-year period, these net inflows totalled A$5.7bn. Unlike investors elsewhere, Australians added less to index funds – net A$3.6bn. Even so, Calastone’s Fund Flow Index rated the passive flows higher because they took place on lower overall transaction volumes, indicating greater investor conviction. To this extent, Australia follows the global trend.

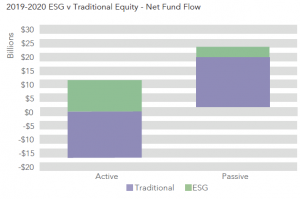

ESG strategies a significant contributor to the success of active global equity funds

There is one area where the active fund management industry is mounting a hugely successful defence against the rise of index trackers – ESG funds. They are the undisputed success story of the last two years for the asset management industry. From a near standing start, they have captured investor imagination to such an extent that over the last two years, they have taken an astonishing $84 in every net $100 flowing over our network into equity funds of any kind, a total of $15.1bn out of $18.1bn. Net inflows rose seven-fold between 2019 and 2020, even though overall turnover in ESG funds only doubled. The last four months of 2020 saw greater inflows than the rest of 2020 and all of 2019 combined. Three quarters of this new ESG capital ($11.3bn) flowed into active funds.

Australian investors are a little behind the ESG curve compared to UK and Europe

UK and European investors have been the keenest buyers. Based on fund flows, Australian and Asian investors appear to be about two and three years behind the curve respectively, though appetite is growing. In 2019 and 2020, Australian investors added just A$1.2bn to ESG equity funds, only A$1 for every A$13 that flowed into equity funds of any kind – a fraction of the global average.

Figure 4: Globally, three quarters of new ESG capital (US$11.3bn) flowed into active funds. If we strip out ESG funds altogether then traditional active funds have shed US$16.8bn over last two years.

Edward Glyn, Head of Global Markets at Calastone, said, “The long bull market has favoured passive funds – savers are quite happy to ride a rising index and take the simple market return. But passive investors are all-in on market bubbles and market crashes alike. Moreover, the rise of mega-caps like Apple and Amazon has increased absolute risk for passive investors, even if a fund continues to mirror the market perfectly. This is a sort of hidden risk.

In more challenging market times, many argue that active managers should be able to mitigate the risk of volatile markets and therefore generate outperformance. Investors generally have greater aversion to losses than they have appetite for gains so they should logically opt for active funds in times of trouble. There has not, however, been a sustained bear market for more than a decade, as even the convulsions caused by the onset of the pandemic were quickly sedated with enormous quantities of central bank liquidity and government cash.

At Calastone it is not our role to say one kind of fund is better than another – this is a job for financial advisers and investors themselves. But because we handle such huge volumes of investor trades, we are uniquely well positioned to observe the behavioural trends, picking up turning points long before anyone else is able to.”

Ross Fox, Managing Director, Head of Australia and New Zealand at Calastone, said, “Australians are pretty patriotic when it comes to their investments. More than a third of the money they added to equity funds in 2020 went into funds that only invest in Australian equities. In Europe, the UK, and most of Asia, investors prefer to take a more global approach. In Australia, discourse in the financial services industry is more frequently turning to ESG. The topic is still more muted than in the UK and Europe and the home-market bias leaves investors with fewer assets that would meet global ESG standards. Across Asia, the speed at which attitudes are changing depends on the level of market development.

“Calastone’s new Fund Flow Index (FFI) will launch in Australia later this year. It will provide detailed quarterly insight into Australian investor behaviour, tracking which fund categories are attracting most new capital and which are out of favour and suffering outflows. We look forward to keeping you posted.”