LendIt USA Conference April 11-12

Australian Fintech is excited to be a Media Partner for the upcoming LendIt USA conference taking place in San Francisco on April 11-12. LendIt USA is the world’s largest annual gathering of the online lending community where established and emerging platforms, investors and technology providers from around the world come to learn, network and do business. Now in its fourth year, the 2016 event will be the largest online lending expo in history with 4000 attendees. This is your chance to share ideas with innovators and leaders in marketplace lending. Confirmed speakers include: · Renaud Laplanche, Founder & CEO, Lending Club · Ron Suber, President, Prosper Marketplace · Peter Thiel, Entrepreneur & Investor · John […]

truRating launches in Australia, empowering businesses to capture mass customer feedback at point-of-payment

Award-winning UK-based point-of-payment rating system, truRating, has officially launched in Australia, giving businesses a straightforward and cost-effective way to collect immediate feedback from their customers when they pay. Using the payment terminal, truRating presents customers with a single feedback question, asking them to rate an aspect of their experience using a scale of 0-9 on the keypad. This gives companies a real-time, mass-market view of customer satisfaction and overall company performance on key metrics such as service, value or product selection, providing the insight they need to make changes and improvements. The UK fintech startup has demonstrated impressive growth, with over one million ratings processed globally to date, averaging 8,000 […]

UK fintech startup truRating knew Australia would be a prime market

“Australia was in our sights early on as a prime market for truRating to launch in following our early success in the UK. Our local market research demonstrated that consumers want a simple and anonymous way to provide feedback about their experiences to businesses and truRating is committed to delivering that capability via our world-first technology. The rapidly growing fintech scene and market potential we identified here cemented Australia as the natural next step. Australia has a flourishing startup ecosystem which is producing world-class technologies and truRating is proud to join the mix.” – Georgina Nelson – CEO & Founder truRating

Target market for robo-advisers to grow with net usage

Robo-advice does not work well in complex situations but suits people in their 30s and 40s who are already using the internet to manage their finances and are starting to save serious money toward retirement. Robos work very well where the investor’s situation is not complex and a person neatly fits into one of several predetermined categories. For example, the small but relatively focused subset of people in their 30s and 40s who are starting to save serious money toward retirement are perfect for robos. They may have already looked at negative gearing and margin lending to grow their savings but feel disinclined to take on the added risk in […]

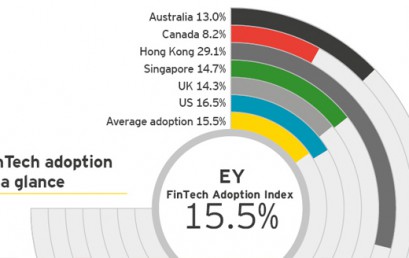

Fintech adoption tipped to double in 2016

The level of fintech adoption among consumers is set to grow significantly in the next 12 months, new research has revealed. EY’s inaugural FinTech Adoption Index – a survey of 10,131 digitally-active consumers in Australia, Canada, Hong Kong, Singapore, the UK and the US – found that 15.5 per cent had used at least two fintech services (financial services products developed by non-bank, non-insurance, online companies) in the past six months. It also suggested that adoption rates among digitally active consumers could double within the next 12 months. EY Australia’s fintech leader, Anita Kimber, said it is a change that will require traditional financial services companies to revisit their product, […]

Blockchain and how it will change everything

In May, British billionaire Richard Branson invited a select posse of entrepreneurs, venture capitalists and technology advisers to his Caribbean residence for an exclusive pow wow on an issue occupying some of the top markets minds in the world. The topic for discussion on the picturesque Necker Island was the “blockchain”. “Every now and then, something comes along that might just change everything. And this is one of those moments,” ASX chief executive Elmer Funke Kupper. In case you’re one of the many yet to wrap your head around the promising technology, blockchain, on a simple level, uses computer code to engender trust in digital-economy transactions. One of the attendees […]

‘EY Fintech Adoption Index’ – out today

Ernst & Young have now released their ‘EY Fintech Adoption Index’ which outlines how quickly the market is taking up FinTech products. While we are a market leader in the adoption of credit card contactless payment technologies we are slow to take up FinTech products. As our market matures this is sure to change. Exploring a new financial services landscape Driven by innovative startups and major technology players, the booming FinTech industry is capturing traditional market share by offering customers easy-to-use and compelling products and services. We surveyed more than 10,000 digitally active people in Australia, Canada, Hong Kong, Singapore, the United Kingdom and the United States to better understand […]

Fintech’s advantages: financial technology revolution is a boon for investors

There are definitely a lot of exciting new opportunities for investors to get involved in FinTech. Whether its investing capital in the products that are offered by new FinTech companies or direct investment in these companies now is the time. We are starting to see more and more articles about the opportunities in main stream media and we must surely be about to reach the tipping point. In my own experience the mention of FinTech is drawing fewer and fewer blank stares today than it was even a few months ago. A ‘Financial Revolution’ is a great way to describe our current position. We would love to hear your thoughts […]