British fintech Payrow launches banking services for businesses with complex ownership structures

Payrow, a new British fintech that provides banking services for entrepreneurs and flexible workers, announces banking services support for businesses with complex ownership structures. Leveraging its strong market experience, Payrow is now ready to onboard businesses with complex ownership structures in the United Kingdom. With a team of experts specialising in dealing with such businesses and strong KYC processes, Payrow can efficiently upload the required number of beneficiaries during business registration and easily offer all the necessary banking services from day one.

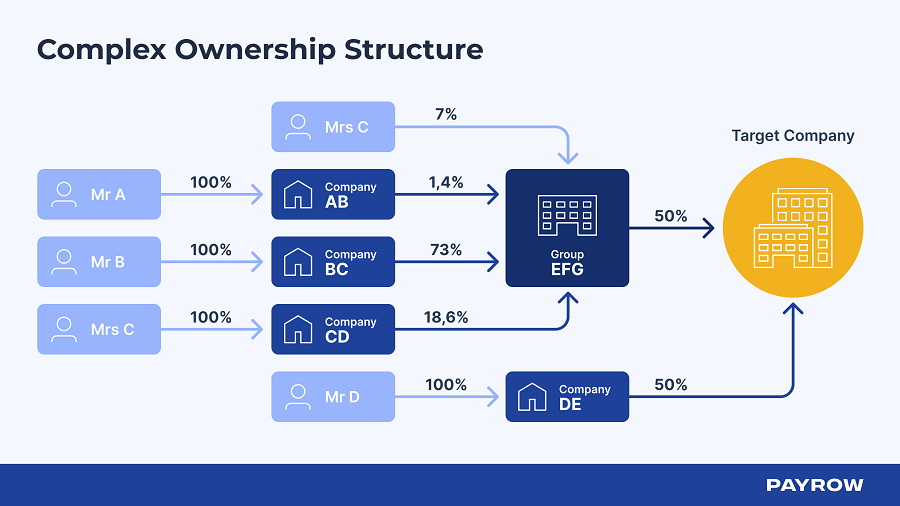

Complex ownership structures are often found within companies with different overseas departments or companies linked together by a chain of ownership. These companies will often have several layers of corporate officers, shareholders and PSCs (Persons of Significant Control), which makes identifying the owners fairly difficult.

Here is an example of a complex ownership structure:

This lack of transparency deters many traditional and challenger banks from offering banking services to businesses with complex ownership structures, as even basic services like opening a bank account require long waiting times and paperwork. If a bank does agree to work with a complex structure company, opening a bank account will often mean long waiting, submitting a lot of paperwork and potentially experiencing service problems.

Dinu Popa, Head of Compliance and MLRO at Payrow commented, “Business needs in our markets are constantly changing and at Payrow we are perfectly equipped to support complex ownership structures. With our new service, these businesses don’t have to jump through so many hoops and gather endless paperwork trails. We have a strong compliance team and unparalleled experience when it comes to offering banking services to businesses of all sizes, which puts us in the best position to onboard these complex ownership businesses faster and in a more comprehensive manner than anyone else.”