Amsterdam payment fintech unicorn Mollie enters UK

Amsterdam-based payment fintech unicorn Mollie is expanding into the UK market to help merchants with European growth post-Brexit.

Welsh fintech Yoello continues its rapid international expansion landing in Australia

Welsh fintech Yoello has continued its trajectory of international growth this year by entering the Australian hospitality market.

Paddle launches Paddle Pilot to boost payment acceptance for fast-growing B2B SaaS companies

Paddle announce the launch of Paddle Pilot, a new set of features that helps businesses increase their payment acceptance and capture more revenue.

Rapyd raises $300 million in funding to support accelerated growth within the global payments industry

Businesses can accept and send payments without having to build their own infrastructure through the Rapyd Global Payments Network.

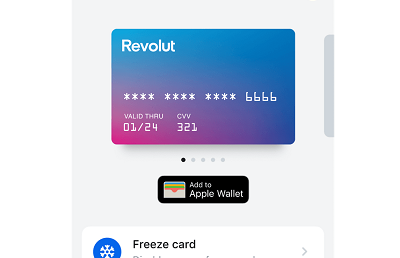

Revolut makes virtual cards free for Irish customers amid Covid-19 ecommerce boom

Cashing in on the online shopping boom, fintech Revolut has rolled out virtual cards for its 1.2m Irish customers.

UK FinTech Paymentology achieves Visa Ready certification

UK FinTech Paymentology has been granted a Visa Ready certification, allowing it to empower banks to offer tailored products.

Singaporean fintech firm sets up operations in Edinburgh

TranSwap, a cross-border payment platform based in Singapore, has based its first UK office in Edinburgh.

DNA Payments acquires Active Merchant Services

DNA Payments Group, a fast-growing vertically integrated payments company, has acquired Active Merchant Services operator of Active Payments.