Octopus Money selects Aveni’s AI solutions to enhance adviser and coaching team

Aveni.ai, specialists in Artificial Intelligence (AI) for financial services, has agreed a new partnership with Octopus Money.

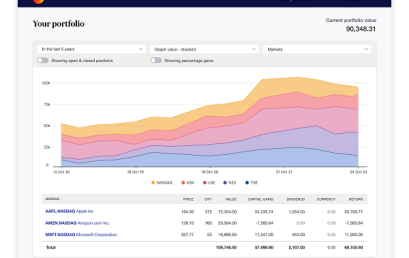

Investopedia names Sharesight best portfolio tracker for DIY investors

Investopedia has named Sharesight the Best Portfolio Tracker for DIY Investors in its 2025 ‘Best Portfolio Management Software Tools’ review.

DTCC’s GTR to add MiFID/R reporting capabilities to further support market participants with transaction and trade reporting obligations

DTCC to add a Markets in Financial Instruments Directive/Regulation ARM service to its Global Trade Repository service in support of evolving transaction and trade reporting requirements.

Blink Payment and ParaCode partner to modernise insurance payments

UK paytech platform Blink Payment today announces its technology will be integrated into insurance software provider ParaCode’s customer platform.

UK fintech Cardstream partners with Moneris to enable their payment facilitation services in Canada

Cardstream Group have announced that Moneris will leverage Cardstream’s Payment Facilitation-as-a-Service (PFaaS) platform.

ClearBank appoints Mark Fairless as new CEO

Leading UK fintech organisation ClearBank has appointed Mark Fairless, formerly the company’s CFO, as its new CEO.

Bitcoin’s price plunges on strategic Bitcoin Reserve news – but are the markets right?

Bitcoin’s drop on Monday 11 March, 2025 — after President Trump signed an executive order to establish a strategic Bitcoin Reserve for the United States — has been widely misinterpreted.

UK fintech Wirex is now a registered Australian Digital Currency Exchange provider

UK-headquartered fintech Wirex have announced that Wirex is now a registered Digital Currency Exchange provider in Australia.