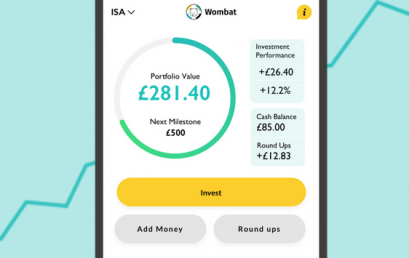

Wombat partners with Currencycloud to launch its new, free Instant Investing service to open up investing for a wider market

UK fintechs Wombat has partnered with Currencycloud to launch its new, free, Instant Investing account.

Lift Global Ventures set to take off with UK IPO

It is not often that there is a new angle on the stock market, whether in the UK or otherwise. Lift Global Ventures is changing that.

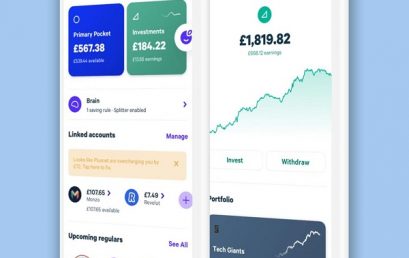

Irish users of Plum app to get stock trading feature

UK fintech company Plum is to roll out a stock trading feature in Ireland in the coming months, will allow users to invest in US stocks.

KX enhances its white-label foreign exchange trading platform, KX Flow

KX, a worldwide leader in real-time streaming analytics, has today announced enhancements to KX Flow, its white-label foreign exchange trading platform.

Fintech Wise to pioneer direct listing in boost to London

UK fintech Wise (previously TransferWise) has announced it plans to go public with the first direct listing on London’s main market.

Spanish brokerage platform launches open banking payments with Truelayer

HeyTrade’s customers can use TrueLayer’s open banking infrastructure to top up their accounts instantly using the fintechs Payments Initiation Service.

UK trading platform eToro to go public in $10bn SPAC deal

Trading giant eToro has confirmed reports that it is due to list via a $10bn SPAC deal. The Israeli fintech announced it would go public at a valuation of $10.4bn after merging with FinTech Acquisition Corp. V (FinTech V), a publically-traded SPAC run by American businesswoman Betsy Cohen. A SPAC (special-purpose acquisition company) is a way for companies to go public without going through all the hassle and expense of an IPO (initial public offering). Cohen founded Bancorp, a bank holding company based in Minneapolis, in 1999 and subsequently FinTech V, which raised $250m when it listed on the NASDAQ in December 2020. As part of the deal, eToro will […]

Freetrade preparing to take the plunge Down Under

Freetrade has joined the ever-growing list of UK fintechs setting up in Australia with the investment platform to open an office in Brisbane.