UK fintech Bud introduces revolutionary financial AI product: Bud.ai

UK fintech Bud have announced a groundbreaking innovation, an all-new generative AI core known as ‘Bud.ai’. This cutting-edge technology brings a whole new level of personalisation and data-driven insights to every financial interaction.

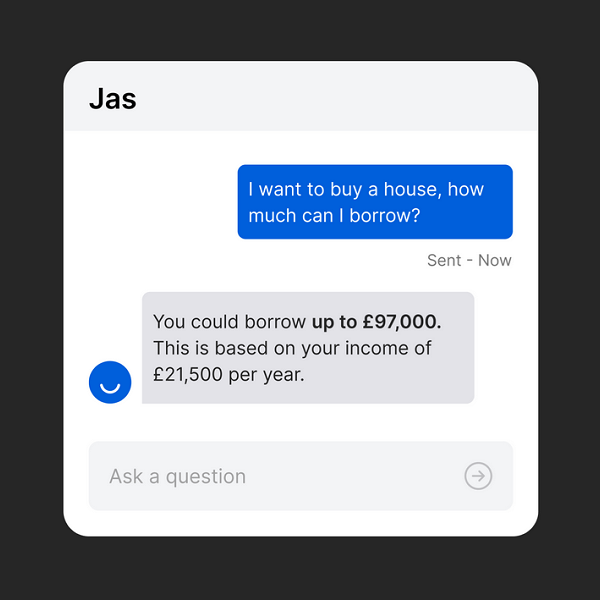

In addition, Bud have also announced their flagship product built upon this powerful core: Jas. This generative interface empowers consumers to engage with a fully-trained AI assistant that is capable of supporting with various aspects of their financial lives, such as the right credit product or financial planning.

With Jas, individuals can take steps to enhance their financial resilience. Financial institutions can also customise this service to align with their specific objectives, such as increasing deposits, serving more mortgages or simply engaging with their customers further.

As Jas evolves, it will transform into an action-bot, capable of providing tailored recommendations and executing tasks on behalf of customers and clients.

At the heart of Bud’s services lies the Bud.ai platform, which unlocks an endless array of insights for their clients. These invaluable insights can supercharge marketing efforts, refine customer segmentation, and optimise business operations.

Bud’s enterprise customers enjoy the seamless integration of Bud’s suite of services, powered by generative AI. The Bud platform enables financial organisations to revolutionise their customer engagements, offering personalised outcomes through customised language models (LLMs) that cater to each bank’s specific requirements.

Since 2018, Bud has been diligently developing foundational language models that leverage financial data. With this latest breakthrough, they have unveiled a logic core capable of delivering countless real-time insights for both individual customers and corporate users.

Bud’s years of experience delivering sensitive data products to large scale enterprises means that they have also tackled one of the key problem statements for gen AI in financial services today: security and location of the data.

Bud locks all of its data down to the specific instance delivered to the clients it serves and layers LLMs over this dedicated environment. This means customers get reliable, secure and personalised generative AI capabilities without compromising on data ethics.

Bud’s Co-Founder and CEO, Edward Maslaveckas, is enthusiastic about the changes this innovation will bring to financial institutions and their customers, stating, “Bud.ai delivers on the product vision we held in 2015,” says Edward. “It’s awesome to see that, after eight years of tireless product and technical work, we can now make this dream a reality.”

Bud is also actively working on an AI-powered marketing and risk management suite, which will provide an intelligent layer of data insights across the entire organisation.

With Bud.ai, internal marketing and data teams gain real-time access to their financial data, empowering them to generate actionable insights with unprecedented efficiency.

Bud’s flexible system allows each core model to be trained and configured according to the unique needs of their clients, ensuring a truly customised and tailored experience.

Bud is excited to revolutionise the financial landscape, bringing the power of generative AI to every customer engagement.