Yayzy to help use Open Banking for off-setting carbon emissions

Yayzy is selling carbon off-setting services directly as its prime monetisation strategy with a flat fee.

How Brexit could help London evolve from a Fintech center into a DeFi hub

The popularity of DeFi has exploded over the last year or so, growing to a $16 billion global market.

The great British fintech invasion

Some three dozen British fintech companies have set up shop in Australia in the past 12 to 18 months, even with the closed borders.

Tradefeedr closes $3m funding round

Tradefeedr, a London, UK based trading analytics workflows company, has raised $3m in early-stage financing.

UK international trade department unveils fintech match-making initiative

The UK’s Department for International Trade has launched a campaign to encourage international financial institutions to invest in British fintech.

GoCardless raise £70m, led by Bain Capital Ventures

GoCardless announced that it has raised £70 million (USD$95 million) in a Series F funding round, led by Bain Capital Ventures.

Blue Star Capital PLC investee SatoshiPay inks money transfer deal with German bank

Blue Star Capital said its investee firm SatoshiPay, has signed an agreement with Bankhaus von der Heydt, one of Europe’s oldest banks.

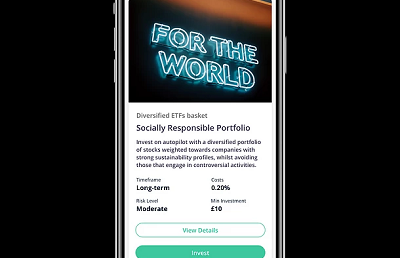

Revolut launches mid-tier subscription plan

Fintech startup Revolut is tweaking its subscription plans with a new mid-tier offering called Revolut Plus.