Fintech star PrimaryBid secures £38 million in new funding from top backers to fuel expansion

Start-up PrimaryBid has secured £38 million in investment from top new shareholders including the London Stock Exchange Group.

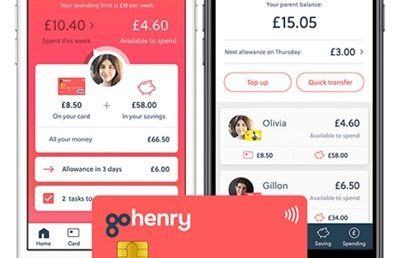

GoHenry launches new teen-friendly account as it promotes financial independence for teens

Financial management app GoHenry has launched a new account aimed at older teens seeking a bit of financial independence from their parents.

Trilo launches Open Banking solution for merchants and consumers

Trilo has launched its Alpha service version in the UK, offering an open banking solution that will serve merchants and everyday consumers.

FinTech Scotland teams up with Lloyds for Innovation Lab

FinTech Scotland and Lloyds Banking Group launch a new fintech programme aimed at improving and creating innovative collaborations.

Visa takes stake in U.K. fintech Global Processing Services

Two weeks after Mastercard invested in Marqeta, its archrival, Visa, has taken a stake in another fintech, Global Processing Services.

Plato signs up with TradeCore

TradeCore partners with Plato, supporting the payments business in bringing quicker, easier and more cost-effective payment transfers.

Why London’s calling for the finTech industry

The year 2020 was going to be a wild ride for London’s fintech and financial services firms even without COVID-19.

Nesta names Open Banking challenge winners

Nesta has named Mojo Mortgages, Moneybox, Plum and Wagestream as the winners of its £1.5 million open banking competition.