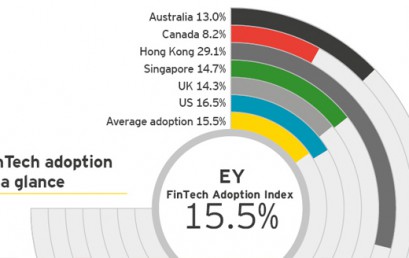

‘EY Fintech Adoption Index’ – out today

Ernst & Young have now released their ‘EY Fintech Adoption Index’ which outlines how quickly the market is taking up FinTech products. While we are a market leader in the adoption of credit card contactless payment technologies we are slow to take up FinTech products. As our market matures this is sure to change. Exploring a new financial services landscape Driven by innovative startups and major technology players, the booming FinTech industry is capturing traditional market share by offering customers easy-to-use and compelling products and services. We surveyed more than 10,000 digitally active people in Australia, Canada, Hong Kong, Singapore, the United Kingdom and the United States to better understand […]

Fintech’s advantages: financial technology revolution is a boon for investors

There are definitely a lot of exciting new opportunities for investors to get involved in FinTech. Whether its investing capital in the products that are offered by new FinTech companies or direct investment in these companies now is the time. We are starting to see more and more articles about the opportunities in main stream media and we must surely be about to reach the tipping point. In my own experience the mention of FinTech is drawing fewer and fewer blank stares today than it was even a few months ago. A ‘Financial Revolution’ is a great way to describe our current position. We would love to hear your thoughts […]

Why fintech is high on the radar for this London Stock Exchange-listed company

Financial technology, or fintech, is finally getting the recognition it deserves as funding pours in and investors begin to warm up to its risky nature. Solving the technological shortcomings of banking institutions and easing payment processes while increasing consumer protection, companies under the segment have been quite instrumental in improving the quality of financial services for both customers and entrepreneurs. Following the success of Lending Club, WePay and Kabbage, dozens of fintech start-ups have entered the fray, and it didn’t take venture capitalists long to flirt with the idea of betting on them. According to the Economic Times, the industry is now worth US$4.7 trillion (AU$6.6 trillion), and have raked […]

Cryptocurrencies: what to study until there’s a ‘bachelor of bitcoin’

Joel Emery’s passion is cryptocurrencies, IT and tax law. It’s dense stuff, but despite a recent senate inquiry, legal treatment of new financial technologies is in its infancy so Emery’s Bachelor of Laws honours thesis at ANU is in some ways ahead of the regulators. Bitcoin emerged in 2008 as the first decentralised cryptocurrency, a form of cash that uses encrypted records to validate transactions and generate more bitcoin and, although crypto-currencies get a bad rap at times, the industry is estimated to already be worth more than $14 billion. Every day, ordinary people walk out of the house without a cent, yet buy coffee, lunch and dinner using a […]

Bitcoin lures as investors fret over uncertain markets

Investors appear to be increasingly turning towards bitcoins, rather than gold, as the best way to protect themselves against unpredictable financial markets. Worries that the US Federal Reserve could make good on its threat to raise interest rates before the end of the year pushed gold to a three-week low overnight, with the price of the precious metal dropping 2.4 per cent to $US1,147.30 a troy ounce. Although the Fed kept interest rates close to zero at this week’s meeting, it flagged the possibility of a rate rise in December, and this triggered a rise both in US dollar and US bond yields – both of which are negatives for […]

Fintech could close $2 trillion SME funding gap

Small to medium enterprises (SMEs) worldwide are struggling for funding from traditional sources, opening up a significant business opportunity for financial technology (fintech) operators. According to a new white paper from the World Economic Forum (WEF), fintech companies are already leading the way in disrupting the financial services space, and are eyeing up the $2 trillion funding gap that exists in the SME credit market. The paper, which was put together by the WEF’s Global Agenda Council on the Future of Finance & Capital, explains that the disruptive tailored services coming from the burgeoning fintech sector include invoice and supply chain financing, equity crowd funding and peer-to-peer lending between SMEs. […]

Bitcoin flounders as regulatory worries bite

What are your thoughts on this article? Do you believe this is happening? Australian businesses are turning their backs on bitcoin, as signs grow that the cryptocurrency’s mainstream appeal is fading. Concerns about bitcoin’s potential crime links mean many businesses have stopped accepting it, a trend accelerated by Australian banks’ move last month to close the accounts of 13 of the country’s 17 bitcoin exchanges. The development is a blow to hopes of bitcoin fans that the currency can play a significant role in everyday business transactions in developed economies, with Australia once seen as one of its most promising markets. It is estimated to hold 7 per cent of […]

Will Bitcoin Finally Bring Down The House Of Medici? | TechCrunch

This article makes a great argument for Bitcoin and explains why we should use it instead of the current process. In the 14th century, the Medici family used the power of its newly invented, double-entry accounting system to build a cross-border banking empire that banks still use today. Now more than 600 years later, cross-border payments total more than $22 trillion. Source: Will Bitcoin Finally Bring Down The House Of Medici? | TechCrunch