Bain Capital to buy Iress’ UK Mortgages business for a total gross cash consideration of £85 million

ASX-listed Iress to divest its UK Mortgage business to Bain Capital Tech Opportunities for a total cash consideration of $164.3 million.

Revolut hiring for new roles to drive the development of mortgages

With a vision to revolutionise mortgages and provide customers with seamless digital solutions, Revolut is looking to hire employees across the world.

UK fintech LendInvest announces £500 million funding partnership

LendInvest has announced a £500 million investment to fund part of its future mortgage originations for its Buy-to-Let and Residential Mortgage products from Chetwood Financial.

Gradual home ownership disruptor Wayhome raises £8m Series A

Gradual home ownership provider Wayhome have announced that they have closed a Series A equity funding round of £8m.

32% of Britons say their bank isn’t doing enough to support them with the cost of living

Britons are changing how they interact with their personal finances and the UK’s banks due to the cost-of-living crisis.

Mortgage fintech StrideUp completes £280 million funding deal

ARA Venn has completed a fund-raise of up to £280m to invest in StrideUp, a digital mortgage fintech company that is co-owned by ARA Venn.

Iress ceases divestment of UK Mortgages business

ASX-listed fintech Iress Limited today announced that it has decided not to proceed with the divestment of its UK Mortgages business.

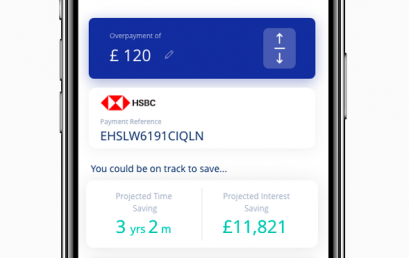

Pay down your mortgage faster with new free app

A new app has been launched to help borrowers make regular overpayments on their mortgage and save money over the longer term.