Curve and Equifax forge partnership

Equifax UK has signed an exclusive agreement with Curve to deliver comprehensive verification and ID solutions to its new personal finance product.

Revolut seeks to join U.S. Online Banking rush with new license

Revolut has asked U.S. regulators for a banking license in a effort to capture more of the country’s switch to online financial services.

New payment platform BOPP launches, giving power back to UK businesses and consumers

New payment platform BOPP uses Open Banking to facilitate immediate, secure payments directly from one bank account to another.

Fintern taps AI and Open Banking to enter consumer loans market

Fintern is aiming to shake up the market for low-value consumers loans with the launch of credit technology that bypasses credit scores.

UK’s biggest lenders to unveil plans for ‘open banking’ rollout

Britain’s biggest lenders will this week unveil proposals for a not-for-profit company to oversee the industry’s attempt to bolster competition.

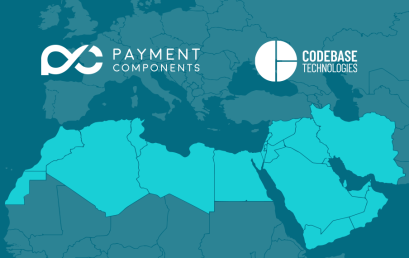

PaymentComponents partners with Codebase Technologies for the MENA region

Codebase Technologies and PaymentComponents have entered into a strategic alliance to further drive the Open Banking in the MENA region.

Atom signs Open Banking deal with Plaid

Atom Bank has signed a deal with Plaid to introduce Open Banking and payment initiation services to small business customers.

Yolt Technology Services brings Open Banking to mortgage lending

ING Bank-backed Open Banking vendor Yolt Technology Services is to expand its Account Information Services to support UK mortgage lenders.