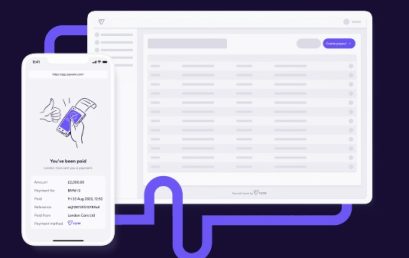

Lending platform Lendable rolls out variable recurring payments with TrueLayer

TrueLayer, Europe’s leading open banking payments network, has today announced a partnership with personal loans platform Lendable.

Global e-wallet STICPAY partners with blockchain research firm Ness LAB

STICPAY announces a new strategic partnership with Ness LAB, a pioneering research company dedicated to building a blockchain-based information economy.

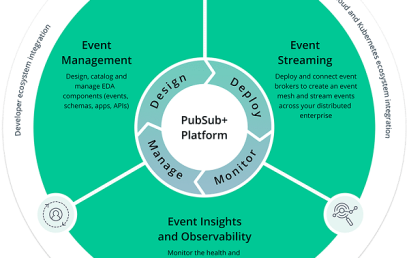

Finalto selects Solace to upgrade its trading platform

Solace announced today that Finalto is replacing its legacy messaging infrastructure with Solace PubSub+ Platform.

Australia’s AMP to work with Starling Bank’s tech to launch new digital bank for small business

Australia’s AMP is working with Engine, the SaaS subsidiary of Starling Bank, a leading UK digital bank.

Vyne tackles out-dated, unreliable payouts with beta launch of no-code verified payouts solution

Vyne, the specialist Open Banking platform, today announced the beta launch of a no-code verified payouts solution.

Sebastian Vetter joins TrueLayer as Country Manager to lead expansion in Germany

TrueLayer, Europe’s largest open banking payments network, has appointed Sebastian Vetter as Country Manager.

TrueLayer offers instant, cost-effective payments through new integration on Shopify’s platform

TrueLayer, Europe’s leading open banking payments network, today announces its new payments app is now live in the Shopify App Store.

Prosper raises £3.2m angel round to build the Wise of Wealth Tech

Founded by Nick Perrett, Ricky Knox and Phil Bungey, new wealth-tech platform Prosper plans to revolutionise how we save and invest.