Primer, the fintech helping merchants consolidate the payments stack, raises £14M Series A

Fintech Primer wants to help merchants consolidate their payments stack and easily support new payment methods, has raised £14m.

Homeppl raises $2 million to challenge the UK’s unfair and outdated tenant referencing system

London based start-up Homeppl has raised $2 million to challenge the UK’s unfair and outdated tenant referencing system.

Open banking fintech TrueLayer to open operations in Dublin

Tencent-back UK fintech company TrueLayer has begun hiring for a new Dublin office as part of a greater push in Europe.

London-based international money transfer platform TransferGo bags £4M

TransferGo has established itself as one of the most trusted money transfer services focusing on delivering, fast, reliable remittances.

Buy-now-pay-later fintech Zilch lands FCA authorisation

Zilch has become one of the first home-grown buy-now-pay-later (BNPL) fintechs to gain consumer credit authorisation from the FCA.

British financial tech company Icon Solutions secures JPMorgan backing

JPMorgan Chase has to back British tech company Icon Solutions who supports banks in overhauling their digital payments systems.

Fintech star PrimaryBid secures £38 million in new funding from top backers to fuel expansion

Start-up PrimaryBid has secured £38 million in investment from top new shareholders including the London Stock Exchange Group.

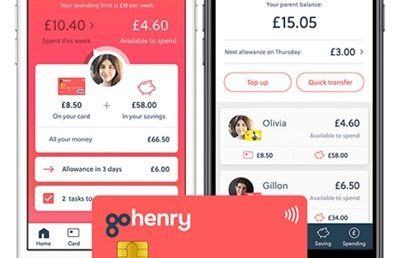

GoHenry launches new teen-friendly account as it promotes financial independence for teens

Financial management app GoHenry has launched a new account aimed at older teens seeking a bit of financial independence from their parents.