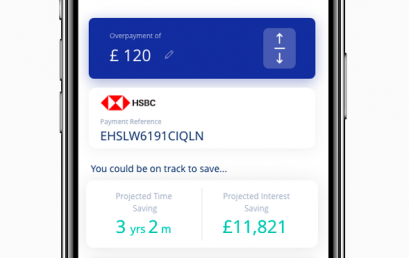

Pay down your mortgage faster with new free app

A new app has been launched to help borrowers make regular overpayments on their mortgage and save money over the longer term.

London-based Tembo Money bags £2.5M funding for helping first time buyers boost their deposits

London-based fintech company Tembo Money have announced that they have closed a £2.5 million funding round.

OpenMoney launches robo-adviser for first-time buyers

OpenMoney has launched its online mortgage advice service for first-time buyers, a year after its initially planned date.

Mortgage advice fintech lands £11m funding

Rather than charging commission or fees for selling homes Strike earns referral fees from mortgage lenders, insurance providers and solicitors.

Digital mortgage lender Better acquires UK fintech Trussle

UK fintech Trussle is a digital mortgage and insurance broker that provides high-quality, independent advice to those looking to buy a home or refinance.

Smartr365 partners with Experian on open banking and credit reference data

Smartr365 has formed a partnership with Experian, giving users access to Experian’s open banking and credit reference data.

Molo teams up with Uinsure for digital insurance solutions

Molo Finance has announced a partnership with Uinsure to offer digital insurance solutions for the buy-to-let market.

Yolt Technology Services brings Open Banking to mortgage lending

ING Bank-backed Open Banking vendor Yolt Technology Services is to expand its Account Information Services to support UK mortgage lenders.