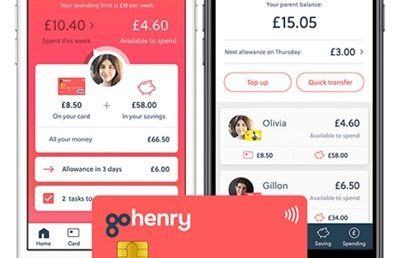

GoHenry launches new teen-friendly account as it promotes financial independence for teens

Financial management app GoHenry has launched a new account aimed at older teens seeking a bit of financial independence from their parents.

Trilo launches Open Banking solution for merchants and consumers

Trilo has launched its Alpha service version in the UK, offering an open banking solution that will serve merchants and everyday consumers.

Visa takes stake in U.K. fintech Global Processing Services

Two weeks after Mastercard invested in Marqeta, its archrival, Visa, has taken a stake in another fintech, Global Processing Services.

Plato signs up with TradeCore

TradeCore partners with Plato, supporting the payments business in bringing quicker, easier and more cost-effective payment transfers.

UK FinTech exporter signs deal to make card payments safer in US

ICC Solutions was created out of the need for businesses to securely test card payments and prevent fraud.

Rapyd launches end-to-end card acquiring ability in Europe

Rapyd’s card acquiring access provides the simplest solution to European companies looking at expanding into different markets.

UK digital bank Ziglu launches P2P payments for Bitcoin and Bitcoin Cash

London-based challenger bank Ziglu said Monday that it has been licensed as an Electronic Money Institution (EMI) by the U.K.’s FCA.

How to manage all your payments messaging with one system

PaymentComponents have a solution that allows banks to manage all payments messaging within the same system.