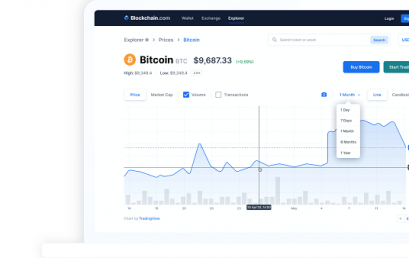

Crypto wallet and exchange company Blockchain.com raises $120 million

Blockchain.com has announced that it has raised a $120 million funding round. The company develops a popular crypto wallet as well as an exchange.

Fintech trends to look out for in 2021

Across various sectors in 2020, people have embraced the challenges and developed innovative solutions. Fintech is no exception.

STICPAY to fulfill increased user demand with redesigned mobile e-wallet app

STICPAY’s e-wallet app is now available in the Google Play Store for Android and in the App Store for iOS devices.

Rapyd launches end-to-end card acquiring ability in Europe

Rapyd’s card acquiring access provides the simplest solution to European companies looking at expanding into different markets.

Fintech: Why It Matters So Much to Your Investment

Fintech is a term that combines two words; Financial and Technology. It means emerging financial services that are fast expanding to include inventions in financial literacy, retail banking, education, investing, and cryptocurrencies. While fintech was initially only applied to conventional technologies that were applied to back-end established clients and financial institutions, the term now refers to how to people operate their enterprises ranging from double-entry accounting to currency invention. Notably, financial technology has grown explosively as mobile internet revolution advances. Facts about Fintech and their applications today In their latest report, Accenture established that international investment in fintech blast through the roof in just a couple of years. From $ […]

Apple says it will overtake Samsung Pay by year’s end

Apple has indicated it plans to launch Apple Pay in a number of new territories before the start of 2018, a feat that would see it catch up to and overtake current digital wallet frontrunner Samsung. Speaking at the company’s earnings call yesterday, Apple CFO Luca Maestri says that “the reach, usage, and functionality of Apple Pay continued to grow.” He claims that “Apple Pay is by far the number one NFC payment service on mobile devices, with nearly 90 percent of all transactions globally. Momentum is strongest in international markets, where the infrastructure for mobile payments has developed faster than in the US.” “In fact, three out of four […]

Search for 2017 Fintech 100 innovators kicks off

Nominations are now open for the 2017 KPMG & H2 Ventures Fintech 100, the annual list designed to recognize leading fintech innovators. Visit www.fintechinnovators.com by Thursday, 31 August 2017 and nominate your company, or any fintech you think should be considered for the Fintech 100. The Fintech100, available at www.fintechinnovators.com, is compiled by fintech investment firm, H2 Ventures in collaboration with KPMG’s Global Fintech practice. The annual Fintech 100 includes both the leading 50 established fintechs, and the most intriguing 50 “emerging stars.” How to nominate and the judging process: Nominations for the Fintech 100 can be made at www.fintechinnovators.com website by Thursday, 31 August 2017. […]

Digital wallet services gain growing acceptance

Money and wallets simply aren’t what they used to be. Tech giants’ card-less payment services — including Apple Pay, Android Pay from Google and Samsung Pay — aim to ease the path to the truly digital wallet, and researchers project huge growth in adoption by retailers and consumers. Even staid financial giants such as Wells Fargo and Bank of America are behind a push to encourage and enable customers to access ATMs without their debit cards. Yet the digital wallet business has gotten off to a rough start, said Bay Area-based analyst Trip Chowdhry, managing director with Global Equities Research. “There have been many false starts in this industry,” Chowdhry […]