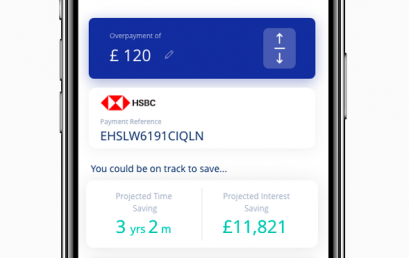

Pay down your mortgage faster with new free app

A new app has been launched to help borrowers make regular overpayments on their mortgage and save money over the longer term.

MarketFinance in pole position as it raises £280m in debt and equity

UK Fintech MarketFinance has announced a £280m debt and equity fundraise and its accreditation under the Recovery Loan Scheme (RLS).

Nucleus Commercial Finance hits £2 bn lending milestone

Nucleus Commercial Finance, the FinTech revolutionising how UK SMEs access finance, has announced that it has reached £2 billion in lending to SMEs.

London-based Tembo Money bags £2.5M funding for helping first time buyers boost their deposits

London-based fintech company Tembo Money have announced that they have closed a £2.5 million funding round.

Prodigy Finance issues $228m of investment-grade asset-backed securities

Prodigy Finance has entered the fixed-income market with the issuance of a $288m investment-grade Student Loan Asset-Backed Securitisation.

Ebury and Earlypay create FX and lending partnership to support Australian SMEs and brokers

Ebury and Earlypay are both committed to providing the Australian SME market with simple and accessible business financing and FX services.

Mortgage advice fintech lands £11m funding

Rather than charging commission or fees for selling homes Strike earns referral fees from mortgage lenders, insurance providers and solicitors.

Digital mortgage lender Better acquires UK fintech Trussle

UK fintech Trussle is a digital mortgage and insurance broker that provides high-quality, independent advice to those looking to buy a home or refinance.