Cashplus Bank Introduces Digital Health Tool For UK SMEs With Mastercard

Cashplus Bank recently revealed that it has become the first UK bank to introduce a Mastercard-powered Digital Health Check tool for SMEs.

Curve and TrueLayer partner to create flexible recurring payment options

Curve is collaborating with TrueLayer to deliver instant bank payments and recurring payment options to its Curve ecosystem.

Revolut partners with Tink for European payments

Tink, and Revolut, have entered into a strategic partnership for open banking technology.

Foxberry expands in Australia with foxf9 developed BetaShares ETF

Foxberry will support BetaShares in their product expansion and see the indexing capabilities of foxf9 gaining recognition around the globe.

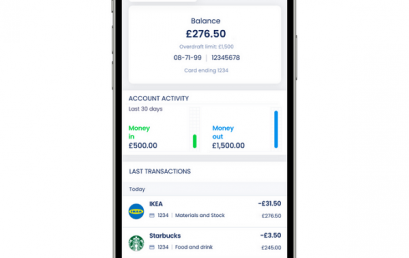

Money app Ziglu partners with ClearBank to offer virtual GBP bank accounts

Cloud-based clearing bank ClearBank has today announced that it is providing agency banking services to UK-based money app Ziglu.

CMC Markets selects TrueLayer for open banking-based collaboration

Leading open banking platform TrueLayer announces its collaboration with CMC Markets, one of the world’s leading online financial trading businesses.

Merchant Hub link up with Gala Technology to provide ‘best in class’ PBL Solution

Merchant Hub have entered into a partnership with Gala Technology to provide their clients with the best in class Pay By Link solution.

TrueLayer and Thunes announce partnership to offer open banking payments across the UK and Europe

TrueLayer, Europe’s leading open banking platform, and Thunes, a leader in global cross-border payments, announced their partnership.