Snowdrop and PwC Middle East partner to empower banks with Transaction Enrichment Technology

Snowdrop Solutions partners with PwC Middle East to bring its innovative Transaction Enrichment API to banks and payment providers in the Middle East.

Moroku, Deloitte and the Isle of Man partner to shape the future of banking and payments

Moroku and Deloitte have been announced as a finalist, representing Australia alongside Gridsight, in the 2024 Isle of Man Innovation Challenge.

Australia’s AMP to work with Starling Bank’s tech to launch new digital bank for small business

Australia’s AMP is working with Engine, the SaaS subsidiary of Starling Bank, a leading UK digital bank.

iDenfy partners with Kestrl to increase conversions through automated KYC and PoA checks

iDenfy’s ID verification, AML screening and PoA verification tools will help Kestrl stay compliant while ensuring efficient and simple customer onboarding.

UK fintechs Currencycloud and Incard partner to help creators and digital entrepreneurs tap global markets

Currencycloud has partnered with Incard to enable its digital entrepreneurs to make quicker, simpler, and value for money international transactions.

Newly licensed UK bank Griffin raises £11 million in a Series A funding round led by MassMutual Ventures

Griffin, the UK’s first full-stack Banking as a Service platform, has raised £11 million in a Series A funding round led by MassMutual Ventures.

MyMonty highlights global expansion with innovative fintech solutions at Seamless Middle East 2023

London-based technology provider Monty Finance has announced ambitious expansion and growth plans at Seamless Middle East 2023.

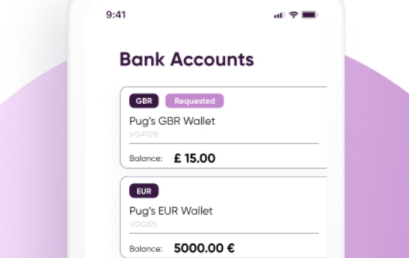

PayPugs and Muniy partner to launch Fintech as a Service

UK fintech startups PayPugs and Muniy have signed an agreement to launch a global Fintech as a Service solution.