Cleva brings the fintech revolution to the UK care sector

Cleva, a UK fintech developed for the home care sector, has launched its payments system for home care agencies

Calastone announces appointment of three strategic hires

Calastone announces three strategic hires to support the next stage of its growth and its mission to digitalise the investment funds market.

Crypto rewards platform Yamgo passes 100k users milestone

Yamgo, a crypto rewards platform built on the Hedera network, has announced that it has officially passed the 100,000 user milestone.

Blue’s latest partnership with Banked revolutionises customer payments

Blue Motor Finance has announced its latest partnership with digital payment provider, Banked to revolutionise customer payments.

Bank Founder Anthony Thomson appointed Chair of Zip UK Board

Anthony Thomson, founder of Metro Bank and Atom Bank, today joins Buy Now, Pay Later (BNPL) provider Zip Co Limited as Chair of the UK Board.

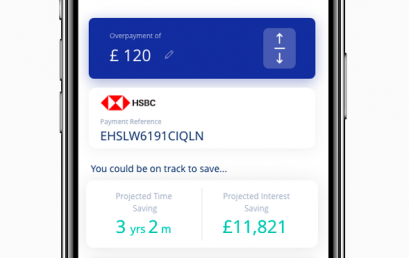

Pay down your mortgage faster with new free app

A new app has been launched to help borrowers make regular overpayments on their mortgage and save money over the longer term.

UK expansion planned for Australian firm Cover Genius

Australian InsurTech company Cover Genius is plotting further UK growth after snagging around £54 million in Series C funding.

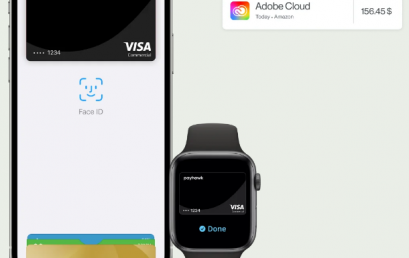

Payhawk announces integration with the digital wallet platform Apple Pay

Payhawk, the growing platform that combines expense, payment and invoice management in one solution, brings its customers Apple Pay.