Brady Technologies acquires risk management platform CRisk

Brady Technologies has announced that it has acquired CRisk, an enterprise risk management platform for the energy and commodities markets.

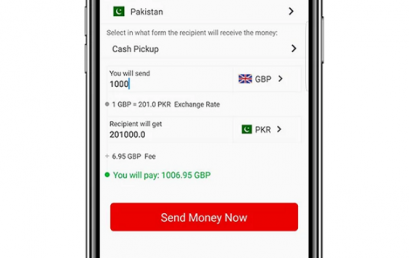

Future FinTech agrees to purchase UK money transfer company

Future FinTech Group announced that it has signed a definitive agreement to acquire 100% of the equity of money transfer company Khyber Money Exchange.

Status Money transforms from financial advice platform to financial services provider thanks to new Railsbank partnership

By partnering with Railsbank, Status Money is evolving from being a financial advice platform to a true financial services company.

iDenfy provides biometric onboarding for Monneo digital banking platform

UK fintech Monneo has chosen iDenfy as their partner for biometric onboarding on the Monneo digital banking platform.

UK banking app Revolut seeks Australian banking licence

Revolut is seeking a banking licence in Australia and is engaged in talks with the country’s regulator to be allowed to take customer deposits.

Angel investor Phillip McGriskin is pioneering new FinTech, Vitesse

Phillip McGriskin has over 20 years of experience in FinTech investments. He has built an extensive portfolio of investments across the FinTech world.

London credit fintech Keebo picks £5M funding ahead of October launch

London-based challenger credit card fintech Keebo has announced that it has closed £5 million in a seed equity funding round.

New neo bank Kroo raises £17.7m series A

New UK fintech Kroo aiming to win a bank license, has raised £17.7m in its Series A funding round as it looks to secure a banking license.